Global Impact Disruptive Innovation

Separate Account Strategy

Investment Strategy

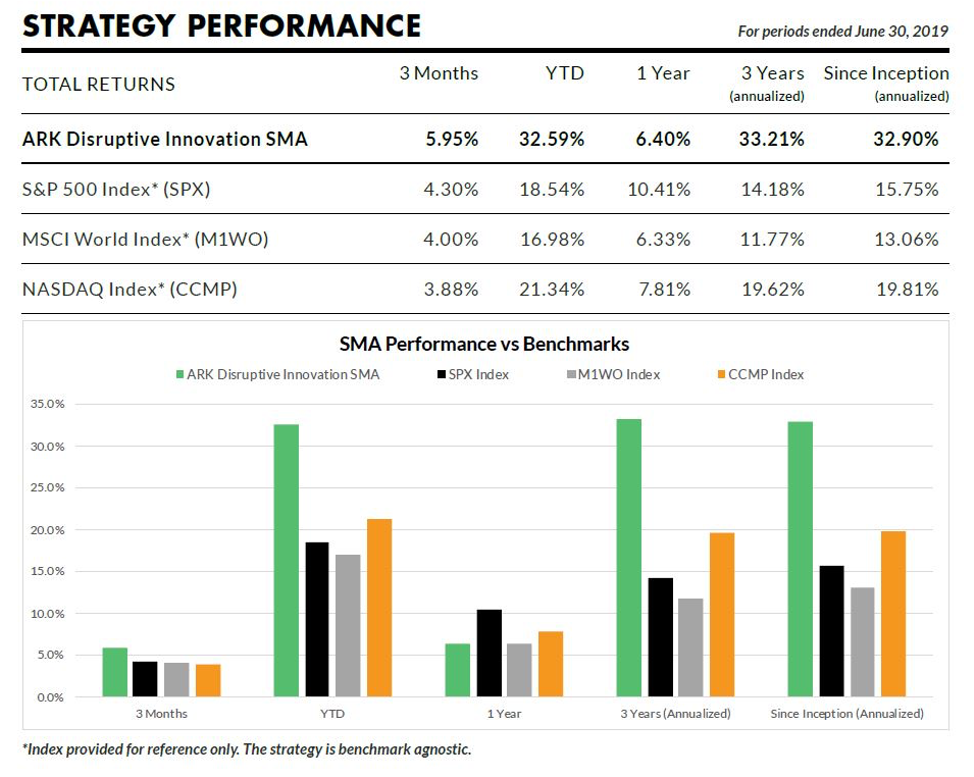

The Global Impact Disruptive Innovation Strategy aims to achieve long-term capital growth by actively managing a concentrated portfolio invested in the public equity securities of companies that are relevant to the theme of disruptive innovation. The portfolio represents ARK’s highest-conviction investment ideas in the areas of DNA sequencing, autonomous technology, energy storage, deep learning, financial technology (fintech) and robotics.

The strategy invests in what ARK believes are the leaders, enablers and beneficiaries of

disruptive technologies. The strategy is benchmark agnostic. It will invest in companies

across multiple sectors and geographies. Portfolios will include issuers across all market

capitalizations, with low overlap to traditional broad market indices.

The strategy is driven by ARK’s unique research process, which incorporates an

open research architecture (Open Research Ecosystem) designed to gain a deeper

understanding of technology in an effort to identify disruptive innovation early.

Profile of an Innovator : Portfolio Manager

Catherine Wood founded ARK Investment Management in 2014. She spent the previous 12 years at Alliance Bernstein as Chief Investment Officer of Global Thematic Strategies that had over US$5 billion in assets under management. Before AllianceBernstein, she worked for 18 years with Jennison Associates as Chief Economist, Equity Research Analyst, Portfolio Manager and Director. Catherine started her career in Los Angeles at the Capital Group as an Assistant Economist.

Investment Philosophy

ARK believes that innovation is key to growth. Disruptive innovation is the introduction of

a technology-enabled product or service that changes an industry landscape by offering

simplicity and accessibility, while driving down costs. Despite its potential, the magnitude

of disruptive innovation and the investment opportunities it creates are often unrecognized

or misunderstood by traditional investors. ARK believes it can outperform broad-based

benchmarks over the course of a full market cycle, with low correlations of relative returns

to traditional growth and value strategies.

Why Invest?

Grounded in Research: Combines top-down and bottom-up research in its portfolio management to identify innovative companies and convergence across markets.

Cost Effective: Provides a lower-cost alternative to mutual funds with true active management in an exchange-traded fund that invests in rapidly moving themes.

Details

Strategy Type: Actively Managed Equity

Asset Class: Global Equity

Vehicle Type: Separate Account

Strategy Inception: 1.3.2016

Typical Number of holdings: 30-40

Sector Weights

- Health Care 30.9%

- Information Technology 27.2%

- Communication Services 18.1%

- Consumer Discretionary 11.3%

- Financials 8.6%

- Industrials 2.1%

- Funds 1.9%

Geography Breakdown

- Americas 86.3%

- Greater Europe 7.5%

- Greater Asia 6.2%

- Middle East 2.7%